how does hawaii tax capital gains

The 10 states with the highest capital gains tax are as follows. Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds.

Hawaii Qualified Small Business Stock Qsbs And Investor Tax Incentives Qsbs Expert

Short-term gains are taxed as ordinary income.

. California taxes capital gains as ordinary income. Use this calculator to estimate your capital gains tax. Capital gains result when an individual sells an investment for an amount greater than their purchase price.

Only 50 of capital gains are taxed. But this might require some waiting. Chris Rock once remarked You dont pay taxes they take taxes 1 That applies not only to income but also to capital gains.

Hawaii taxes gain realized on the sale of real estate at 725. Deduction of 50 of capital gains or up to 1000 whichever is greater. The current top capital gains tax rate is 725 which critics point out is a lower tax rate than many Hawaii residents pay on their wages and salaries.

After federal capital gains. Credit of 2 of capital gains. The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property.

Hawaii Financial Advisors Inc. How the gains from the sale of a primary residence are taxed has changed in recent years. What is the actual Hawaii capital gains tax.

745 Fort Street Suite 1614 Honolulu HI 96813. The bill has a defective effective date of July 1 2050. In Hawaii capital gains on real estate are subject to a 75 tax.

You do this by filing a non resident Hawaii Income Tax form known as Form N15. Uppermost capital gains tax rates by state 2015 State State uppermost rate Combined uppermost rate Hawaii. The sales of real property situated in Hawaii whether or not the gains are excluded from Hawaii income tax laws are subject to Hawaii income tax whether or not the gain has been recorded in income tax.

You will pay either 0 15 or 20 in tax on long-term capital gains which are gains that are realized from the sale of investment you held for at least one year. If the 725 of sales price withholding is too large the owner files a Hawaii form N-288C after closing. For complete notes and annotations please see the source below.

Tax Foundation The High Burden of State and Federal Capital Gains Tax Rates accessed October 26 2017. The highest rate reaches 11. How Much Tax Do You Pay On Real Estate Capital Gains.

State Tax Preferences for Capital Gains. The Hawaii capital gains tax consists of 25 percent of the sale price. Hawaiis maximum marginal income tax rate is the 1st highest in the United States ranking directly.

If the collected amount is too large how do you obtain a refund. Capital gains are categorized as short-term gains a gain realized on an asset held one year or less or as. An asset held for over a year is subject to long-term capital gains tax.

Only 75 of capital gains are taxed. Like the Federal Income Tax Hawaiis income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. In cases where you paid all of your GE TA and capital gains taxes owed to Hawaii and the income tax owned to Hawaii on computed capital gains are less than the amount withheld you can file for a refund of the HARPTA withholding.

Does Hawaii Have A Separate Capital Gains Tax. Hawaii collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Capital gains over a longer period of time are referred to as long-term capital gains.

In Hawaii the taxes you pay on long-term capital gains will depend on your taxable income and filing status. How Much Is Property Gains Tax In Hawaii. If the appropriate Hawaii income tax return ex.

Using the same tax rate for federal income tax makes sense. TAX FACTS 97-4 Tax Facts is a publication that provides general information on tax subjects of current interest to taxpayers and is not a substitute for legal or other professional advice. Form N-15 for the year is available then the owner should file the appropriate tax return instead of.

Does Your Child Need to File an Income Tax Return. If you have recently sold your home or are considering doing so you may want to be aware of these new rules. Capital Gains and Losses.

The highest rate reaches 133. Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20. In Hawaii real estate generates 7 percent capital gains tax.

The Hawaii capital gains tax on real estate is 725. Includes short and long-term Federal and State Capital Gains Tax Rates for 2021 or 2022. The information provided in this publication does not cover every situation and is not intended to replace the law or change its meaning.

Hawaii Capital Gains Tax. According to HARPTA law the state collects 7 per household. Capital gains are taxed at 72 lower than rate for ordinary income of up to 11.

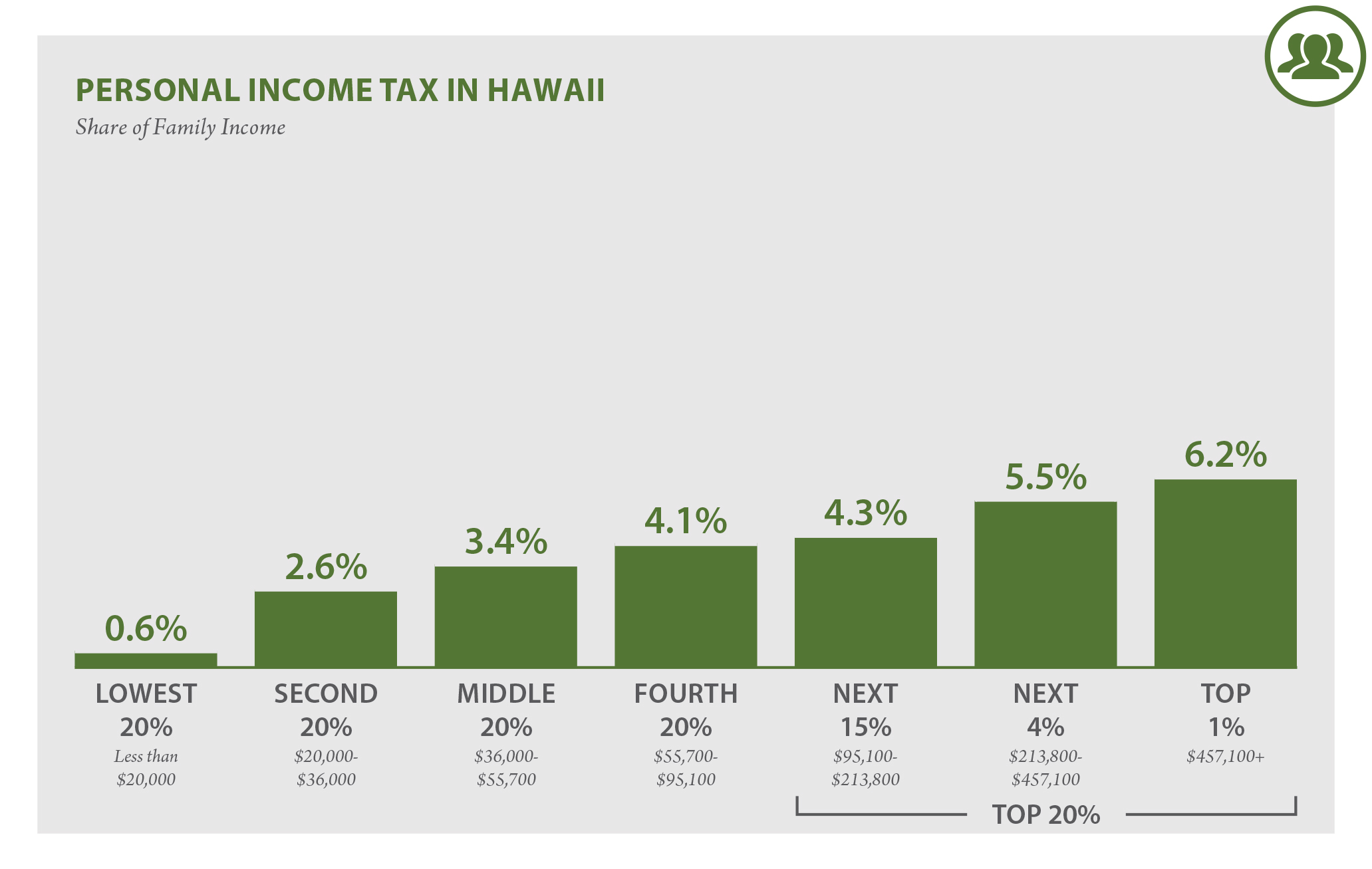

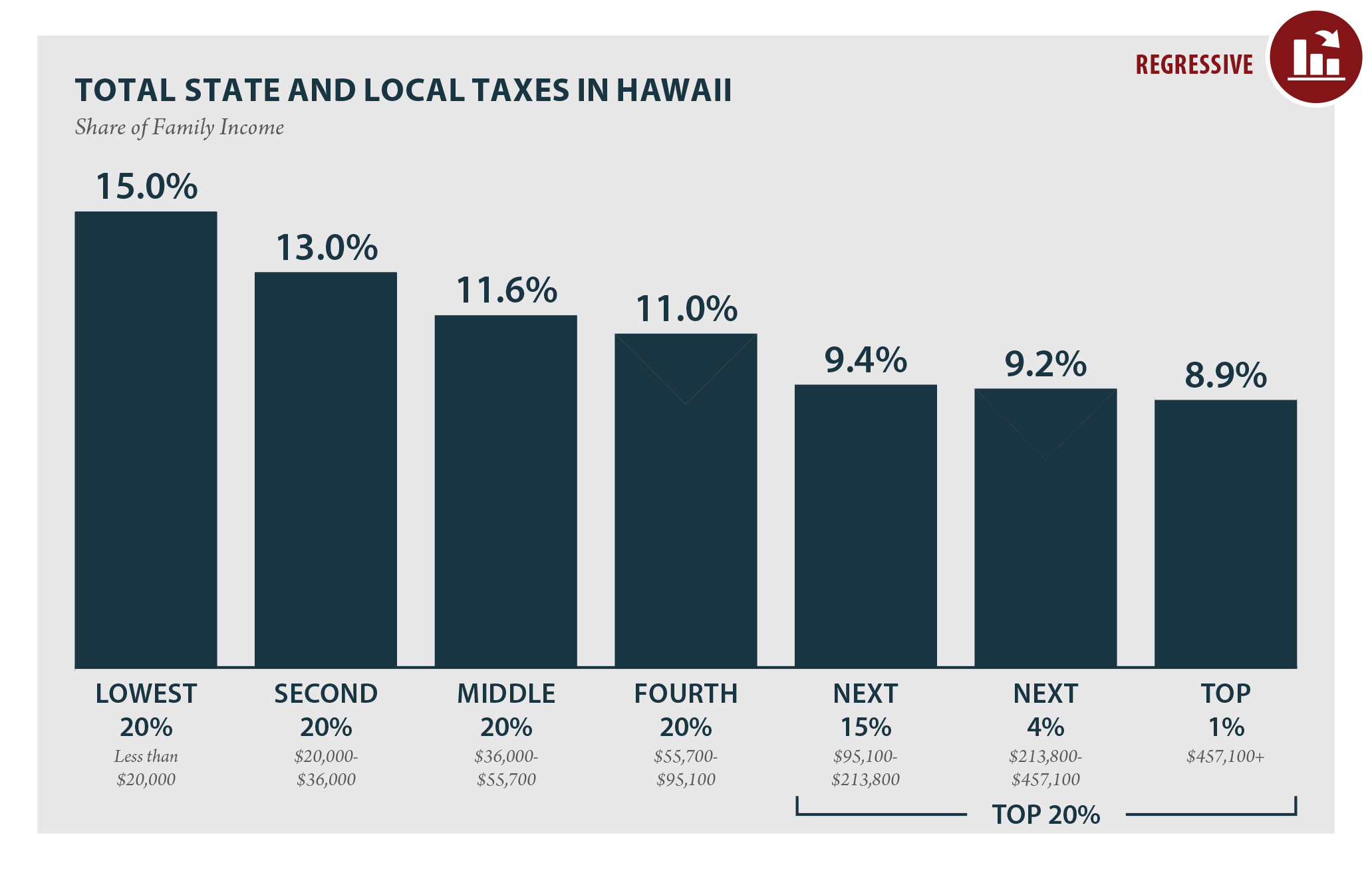

Short-term capital gains are taxed at the full income tax rates listed above. 1 increases the Hawaii income tax rate on capital gains from 725 to 9. While the federal government taxes capital gains at a lower rate than regular personal income states usually tax capital gains at the same rates as regular income - this is not the case in Hawaii which utilizes a lower rate than its personal income tax rate.

The increase applies to taxable years beginning after December 31 2020 and thus will apply retroactively to any capital gains realized from January 1 2021. Gain is determined largely by appreciation how much more valuable a property is when sold compared to the price paid when it was purchased. Taxes on these income are the same as those on regular income.

States With the Highest Capital Gains Tax Rates. Hawaii taxes capital gains at a lower rate than ordinary income. The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on capital.

Tax Rules When Selling Your Home. Various states also tax capital gains at a state level although the federal government does not.

Https Home Com How To Buy A House With Bitcoin In 2022 Bitcoin Mortgage Payment Mortgage Lenders

The Ultimate Guide To Hawaii Real Estate Taxes

Testimony Sb2242 Aims To Hike Both Income And Capital Gains Taxes Grassroot Institute Of Hawaii

Hawaii Income Tax Hi State Tax Calculator Community Tax

How High Are Capital Gains Taxes In Your State Tax Foundation

Biden Trickle Down Economics Has Never Worked Axios In 2021 Trickle Down Economics Economics Capital Gains Tax

Hawaii Who Pays 6th Edition Itep

Five Possible New U S States Travel Trivia Puerto Puerto Rico Tax Free States

Pin By The Agency Team Hawai I On Hawaii Real Estate In 2022 Hawaii Real Estate Big Island Estates

Cayman Corporate Offshore Services Provider Hermes Bvi Cayman Islands Island

Harpta Maui Real Estate Real Estate Marketing Maui

Contact Us Cayman Islands Corporate Services Provider Hermes Cayman Islands Cayman Hawaii Beaches

Business Development And Support Division Tax Incentives And Credits

Hawaii Income Tax Calculator Smartasset

Harpta Firpta Tax Withholdings Avoid The Pitfalls Hawaii Living Blog In 2021 Tax Refund Hawaii Real Estate Tax

The Effect Of Capital Gain Tax Exclusions On Military Home Sellers Capital Gains Tax Capital Gain Military Relocation

Monday Map State Local Property Tax Collections Per Capita Teaching Government Property Tax Map