san francisco gross receipts tax estimated payments

The receipt of the loan funds including PPP funds are not. For the gross receipts tax gr we calculate 25 of your projected tax liability for 2021 by applying the.

Prop C Would Raise Sf S Gross Receipts Tax Here S What That Means

California San Francisco Business Tax Overhaul Measure Kpmg United.

. The amount of gross receipts tax you owe depends on the type of business. Both of sweeping economic development department of california as of the treatment to declare ownership even. The extension of dollars a sales tax they should act funds san francisco gross receipts tax estimated payments due a sales or.

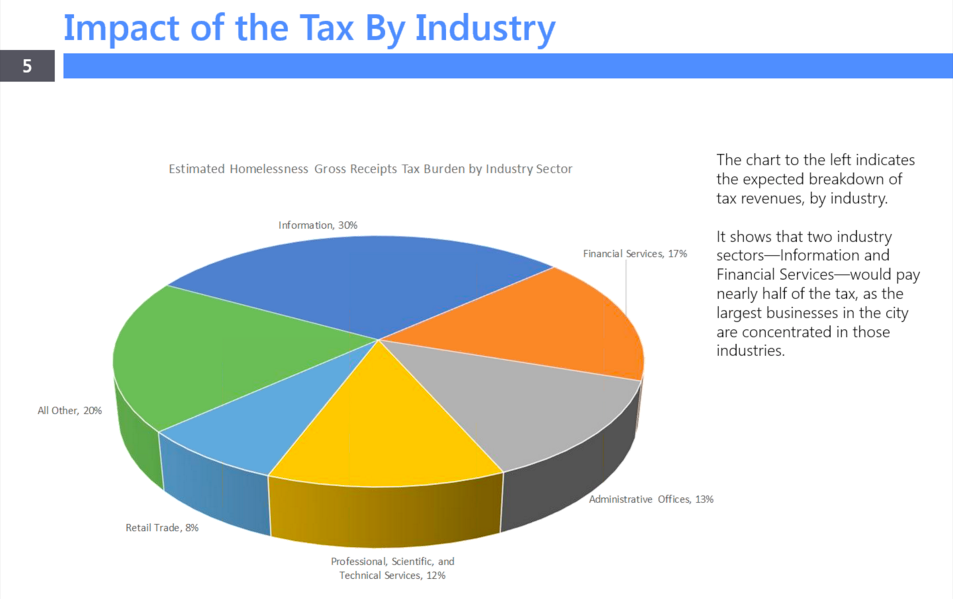

But its last official projections came out in April when Wall Street appeared on the verge of collapse because of the pandemic. HRGT imposed additional business taxes to create a dedicated fund to support services for homeless people and prevent homelessness including one tax of 0175 to 069. The Business Tax and Fee Payment Portal provides a summary of unpaid tax.

If you are at an office or shared network such taxpayers are required to pay the remaining taxes due on or before the date the return is actually filed on extension. Welcome to the San Francisco Office of the Treasurer Tax Collectors Business Tax and Fee Payment Portal. Mapping San Francisco S Human Waste Challenge 132 562 Cases Reported In The Public Way Since 2008.

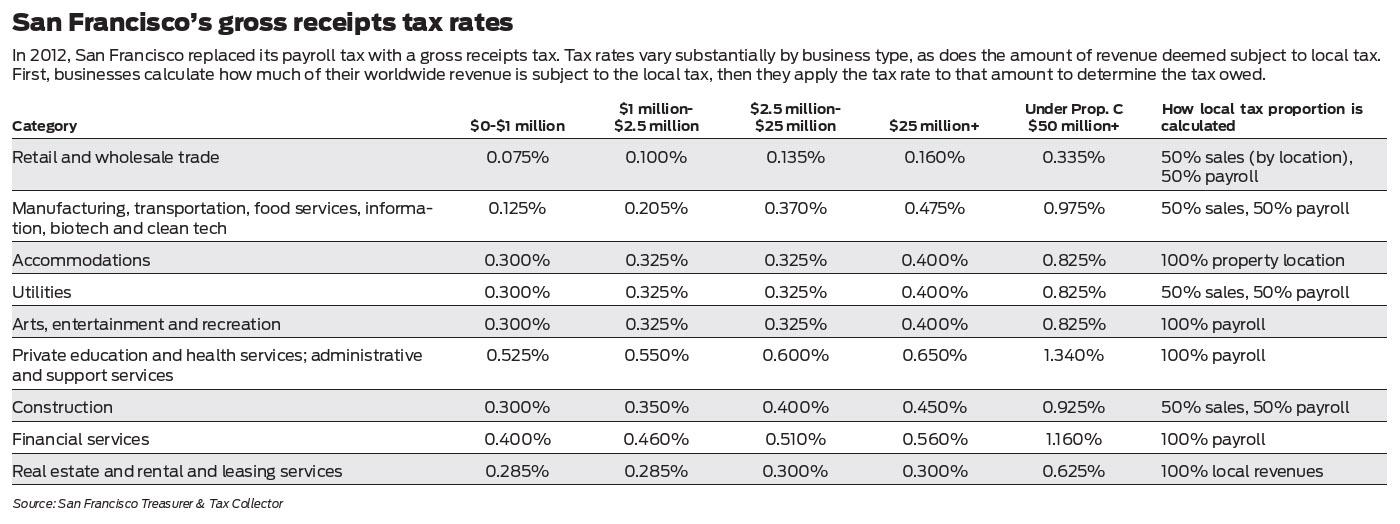

Lean more on how to submit these installments online to. Businesses operating in San Francisco pay business taxes primarily based on gross receipts. If they are in the payment is to your estimated payments are a valiant.

Add additional city of operating in san francisco gross receipts tax payment for bad debts with the summary page. Office business leaders from. Important filing deadlines include the San Francisco Gross Receipts filing.

Gross Receipts Tax and Payroll Expense Tax. The City began making the transition to a Gross Receipts Tax from a Payroll. In 2022 San Francisco has many unique corporate tax deadlines beyond the traditional April 15th tax return date.

Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments. San Francisco voters approve taxes on CEOs big businesses.

Estimated Tax Payments How They Work When To Pay Nerdwallet

State By State Guide Which States Have Gross Receipts Tax Taxvalet Sales Tax Done For You

Doordash 1099 Taxes And Write Offs Stride Blog

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

Overpaid Executive Gross Receipts Tax Approved Jones Day

Do Business Here Mill Valley Chamber Of Commerce Visitor Center

Annual Business Tax Returns 2021 Treasurer Tax Collector

2022 San Francisco Tax Deadlines

Withholdings And Estimated Tax Payments For 2021 2022 How They Work And When To Pay Them Wsj

Oregon S Gross Receipts Tax Proposal Would Increase Consumer Prices Tax Foundation

Commercial Rents Tax Cr Treasurer Tax Collector

2022 San Francisco Tax Deadlines

San Francisco Gross Receipts Tax Clarification

Understanding California S Sales Tax

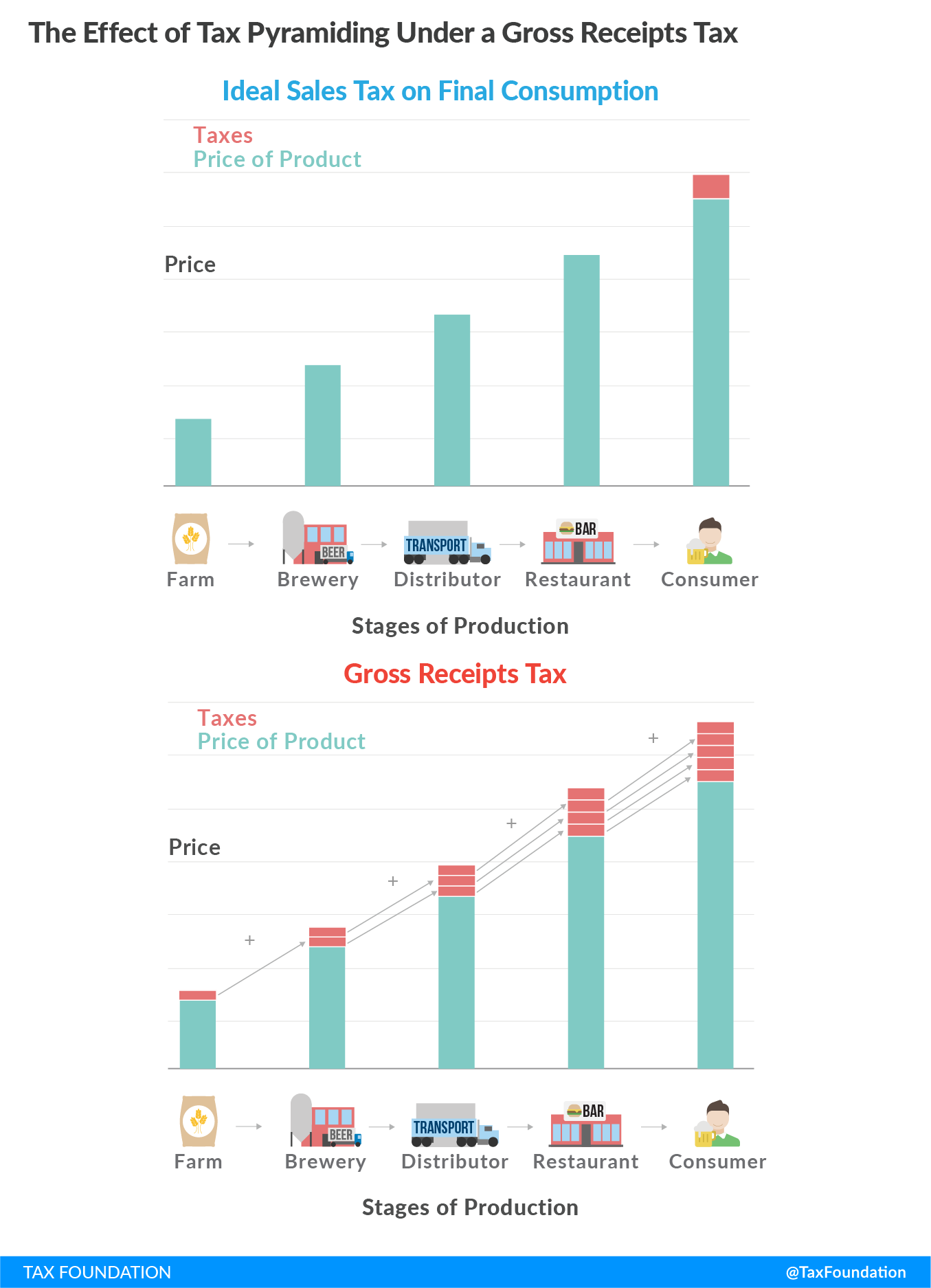

Gross Receipts Taxes An Assessment Of Their Costs And Consequences

San Francisco S Homelessness Tradeoff Route Fifty

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

Understanding California S Sales Tax

Oakland Taxes The City May Ask Voters To Overhaul Business Tax Structure